401(k)

Getting It Right

Because they are highly regulated, it’s important to get 401(k)s right. The Secure Choice Mandate requires private-sector companies with at least 10 employees to provide retirement options. With options including 401(k) and 403(b) plans, which offer higher contribution limits and flexible plan design, we can help you save time and money.

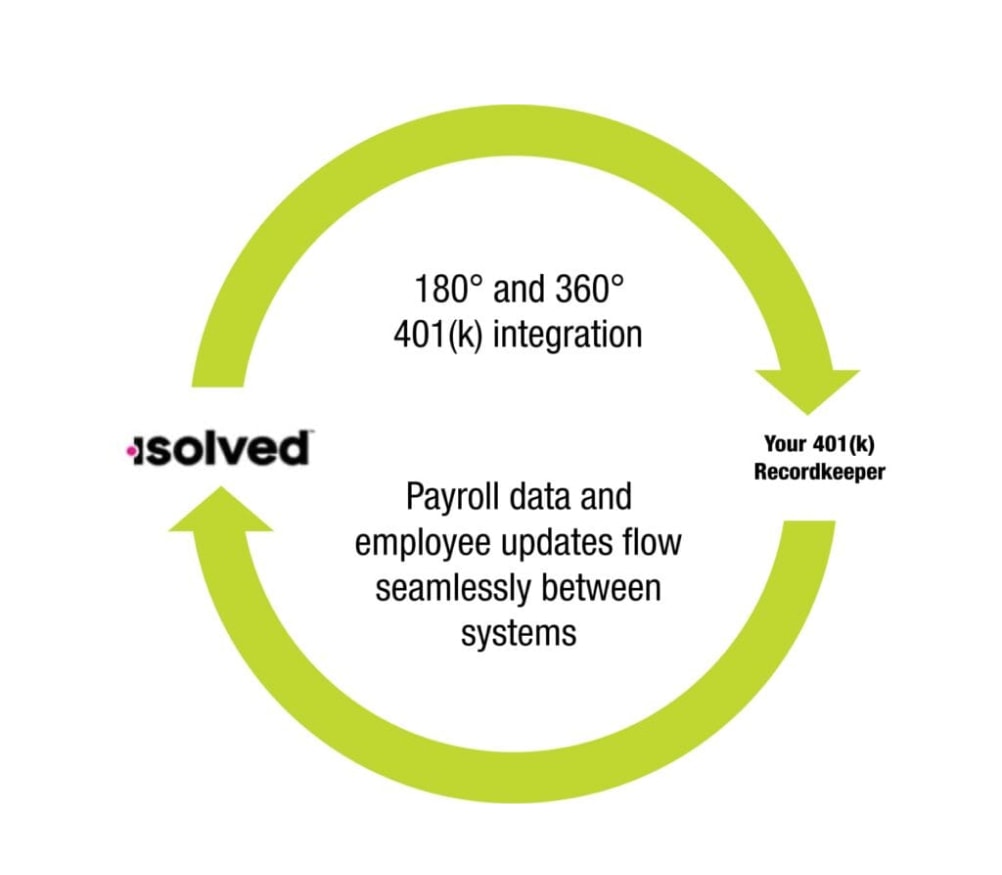

Efficient 401(k) Payroll Integration

Streamline Employee Onboarding

Detect new employees and their plan eligibility. We’ll pre-populate employee information so your team can sign up in a few clicks.

Process 401(k) contributions automatically

Say goodbye to manual work and reduce your risk. Payroll deductions are made securely and accurately from every employee’s paycheck.

Seamlessly sync employee details

Process ongoing changes to contribution rates and employee details on your behalf to ensure that information is always up to date.

Accurate And On-Time From Start To Finish

Pay(k)onnect is the best way possible for us to communicate with your 401(k) recordkeeper. This will help you avoid late or inaccurate submissions (which can trigger IRS-imposed penalties that range from reimbursement of lost interest earnings to plan disqualification) by:

- Eliminating manual data entry into multiple systems

- Increasing efficiency and accuracy

- Reducing your risk of audits and noncompliance penalties

- Providing safe and secure end-to-end encryption

Let’s Go There, Together

Get in touch today so we can start finding the solutions to help you manage your people and transform your business.